How changes to Canada Pension Plan benefits affect your wallet today and retirement tomorrow

May 17, 2023

Canadians Can Receive Financial Payments From These Federal Benefits & Credits In October

October 3, 2023What is the best place to retire in Canada, income-wise?

Your after-tax income in retirement depends on the strategy you choose in drawing income from different sources. It also depends on where you live.

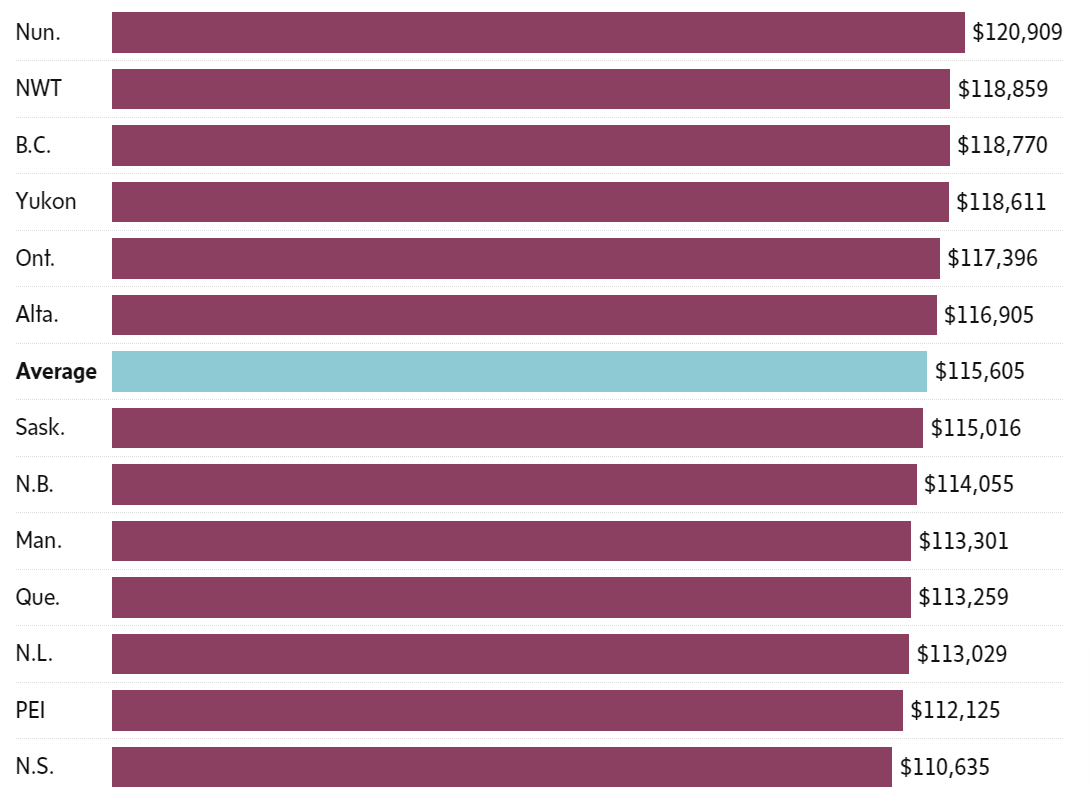

On average, a 65-year-old couple retiring in 2023 with $800,000 in RRSPs and $100,000 in TFSAs would be able to generate total after-tax income including CPP, OAS and GIS of $115,600. (This is the amount expressed in constant dollars so it reflects future inflation.)

As the chart shows, however, the actual amount varies by province and by territory since income tax rates and tax brackets vary across Canada.

What is the best place to retire in Canada (income-wise)?

After-tax retirement income by province and territory (constant 2023 dollars)

SOURCE: TAX OPTIMIZING SOFTWARE FROM MYGOALS INC. ASSUMING A REAL RETURN OF 2.1% AND AN END AGE OF 90; FREDERICK VETTESE

Post Credit: The Globe and Mail By FREDERICK VETTESE

(https://www.theglobeandmail.com/investing/personal-finance/retirement/article-what-is-the-best-place-to-retire-in-canada-income-wise/)